The optimal pension solution

With our Liberty retirement solutions (pillar 3a & vested benefit account), we offer you the best opportunities for a carefree future. You save on taxes, make provisions for your retirement and always have an overview of your growing pension assets

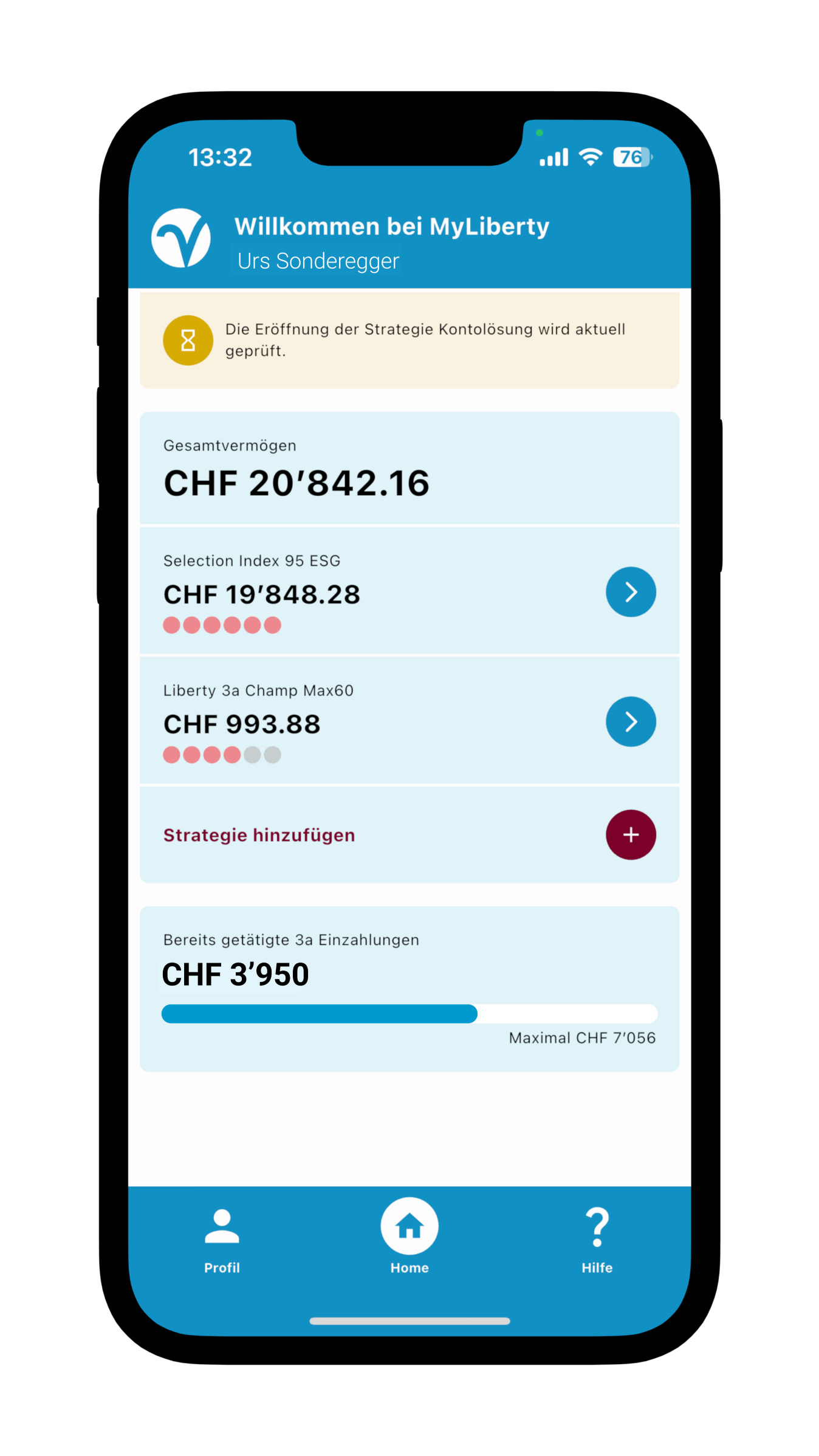

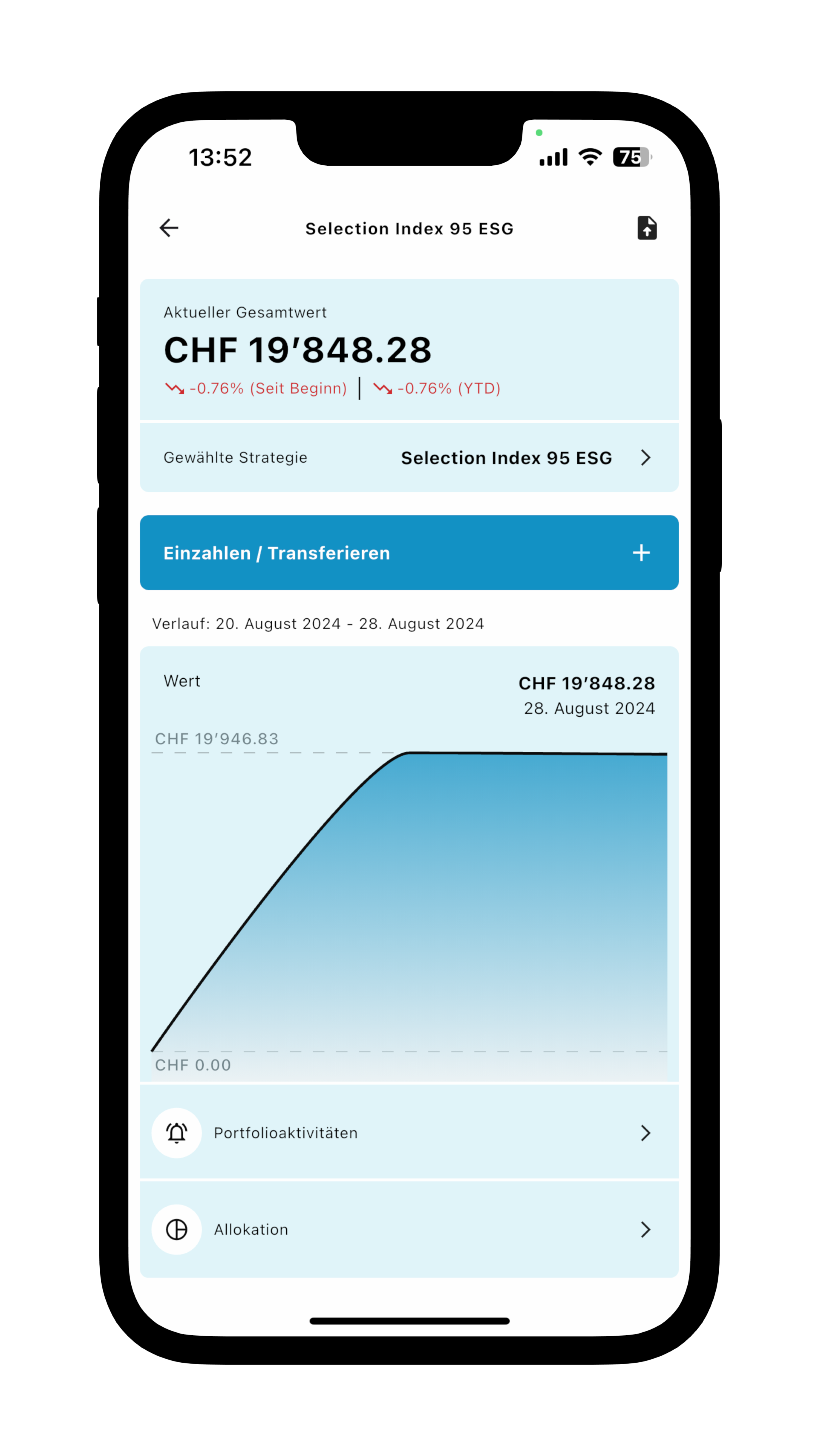

When you open our pension solution, you have the choice of depositing your pension capital securely in an account or investing it in securities . With the myLiberty app, you not only manage your new assets*, you can also conveniently adapt the investment strategies to your needs. Rely on maximum flexibility and keep track of your finances.

*Currently, existing accounts cannot be seen via the app.

New: Liberty vested benefit solution

Discover your financial freedom with the MyLiberty app – thanks to innovative solutions at fair conditions and individually tailored investment options.

Split vested benefit capital easily

Are you leaving your employer and would like to divide your pension fund assets between two vested benefit foundations in order to benefit from tax advantages on withdrawal while remaining flexible?

With the MyLiberty Splitting function, you can conveniently distribute your assets across two vested benefit foundations – for more creative freedom and optimal disbursement of your pension provision.

Liberty pillar 3a

With the MyLiberty app, you can optimize your retirement provision in a targeted manner while reducing your tax burden at the same time – all via the MyLiberty app. Whether you opt for a traditional account or a securities solution: You benefit twice over – from tax benefits and efficient asset accumulation for retirement. Design your investment strategy according to your personal needs and thus reach your financial goals.

Your advantages

These are the best 3 investment target funds per risk level, which are put together for you on the basis of quantitative criteria. The necessary transactions are processed free of charge and without any action on your part.

These are investment strategies with pure index funds and index funds based on the ESG approach (environmental, social, governance). The risk and return of the investment strategies are based on the respective benchmark and are implemented in such a way that the return and risk of the respective strategy correspond as closely as possible to the benchmark.

You remain flexible because there is no obligation to make regular payments.

MyLiberty offers transparent fees in line with the market. Learn more under conditions.

Quality and security are at the heart of our business. Liberty is a reliable pension provider with many years of expertise. All customer balances, which are held in the form of a pure account solution, are held in more than 80 banks. This gives you additional protection in the event of bank failure.

This is how it's done:

Step 1

Download the MyLiberty app and start the registration process by clicking on the "Registration" button. Have your ID/passport, foreigner's identity card (if applicable) and AHV number ready.

Step 2

Follow the next login steps and open your user account

Step 3

After creating the user profile, we will check your details and you will receive your documents within a few working days.