An association solution that creates added value for you

Self-employed persons are not subject to mandatory occupational benefits. They have the option of voluntary coverage through the Swiss Association of Entrepreneurs.

Members have access to pension solutions to protect against the financial consequences of retirement, death and disability. The Association aims to offer its members modern and progressive solutions with attractive risk premiums.

To support its members in their choice of occupational benefits, the Swiss Association of Entrepreneurs offers voluntary occupational benefits to self-employed professionals operating in the following fields:

- Medicine

- Law

- Management Consulting

- Construction

- Finance

- Sport

BVG pension solutions for self-employed persons in the areas of medicine, law, finance, consulting and construction.

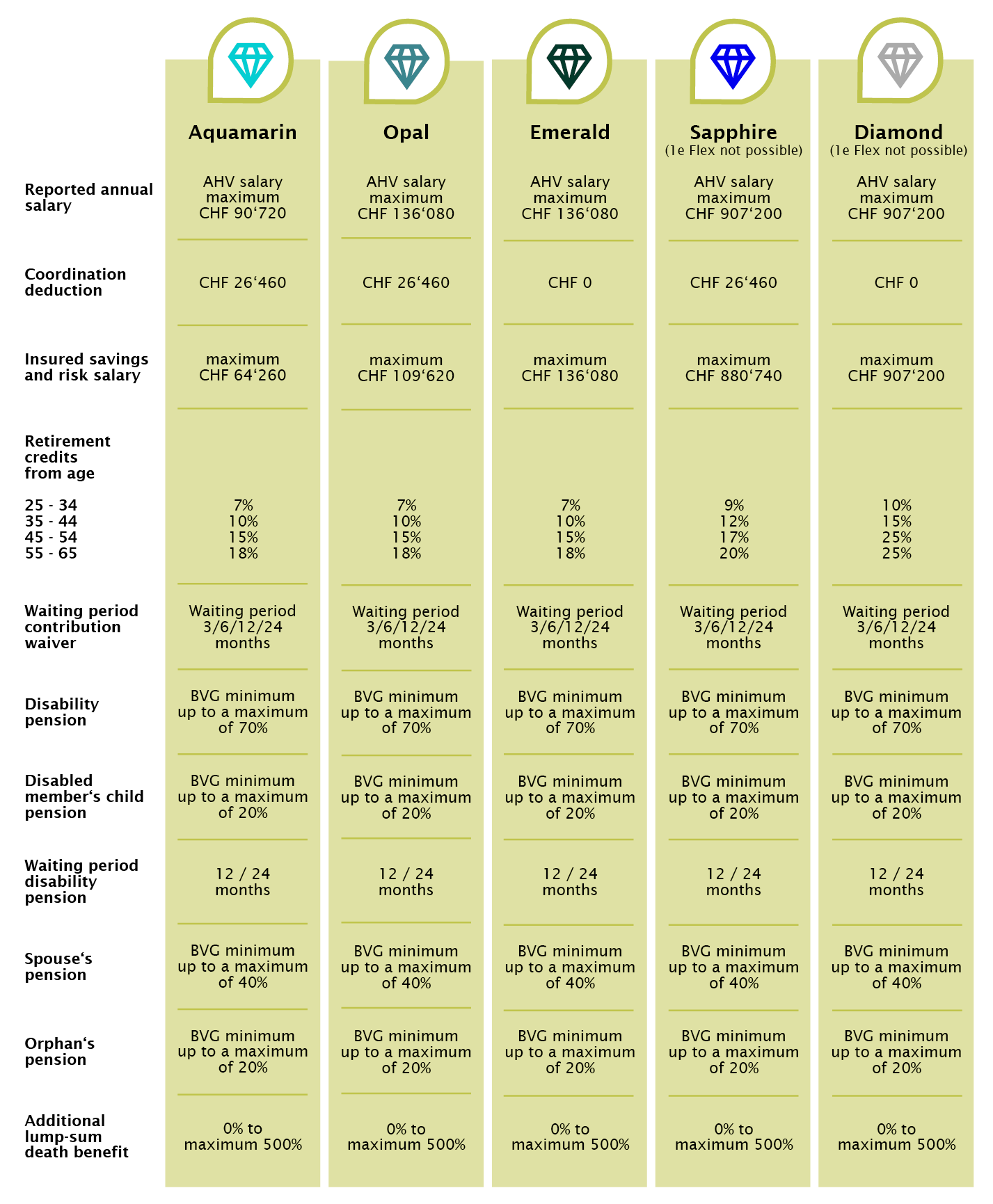

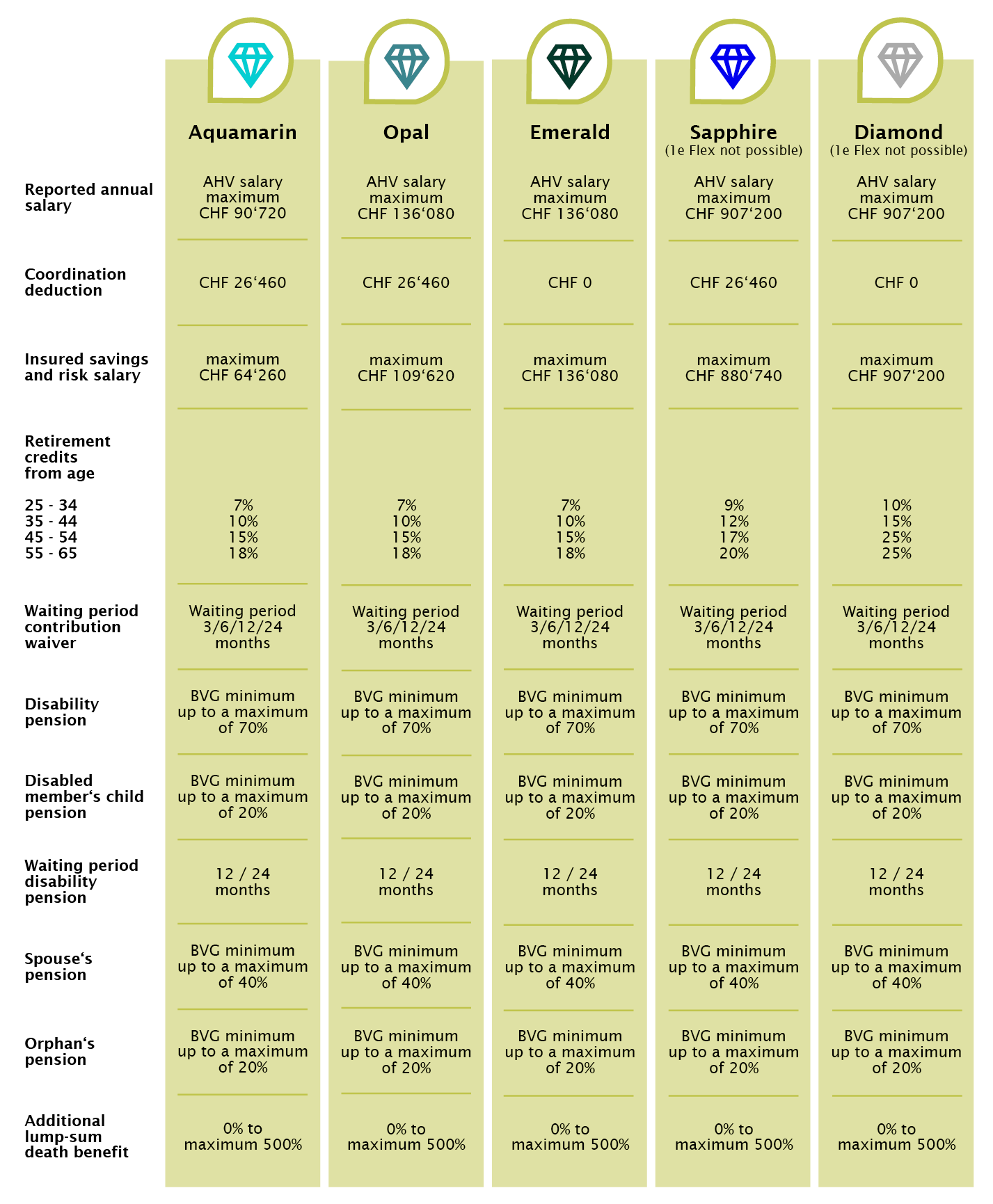

Self-employed persons may choose from one of five pre-defined plans.

1e pension solutions for self-employed persons in medicine, law, management consulting, construction and finance.

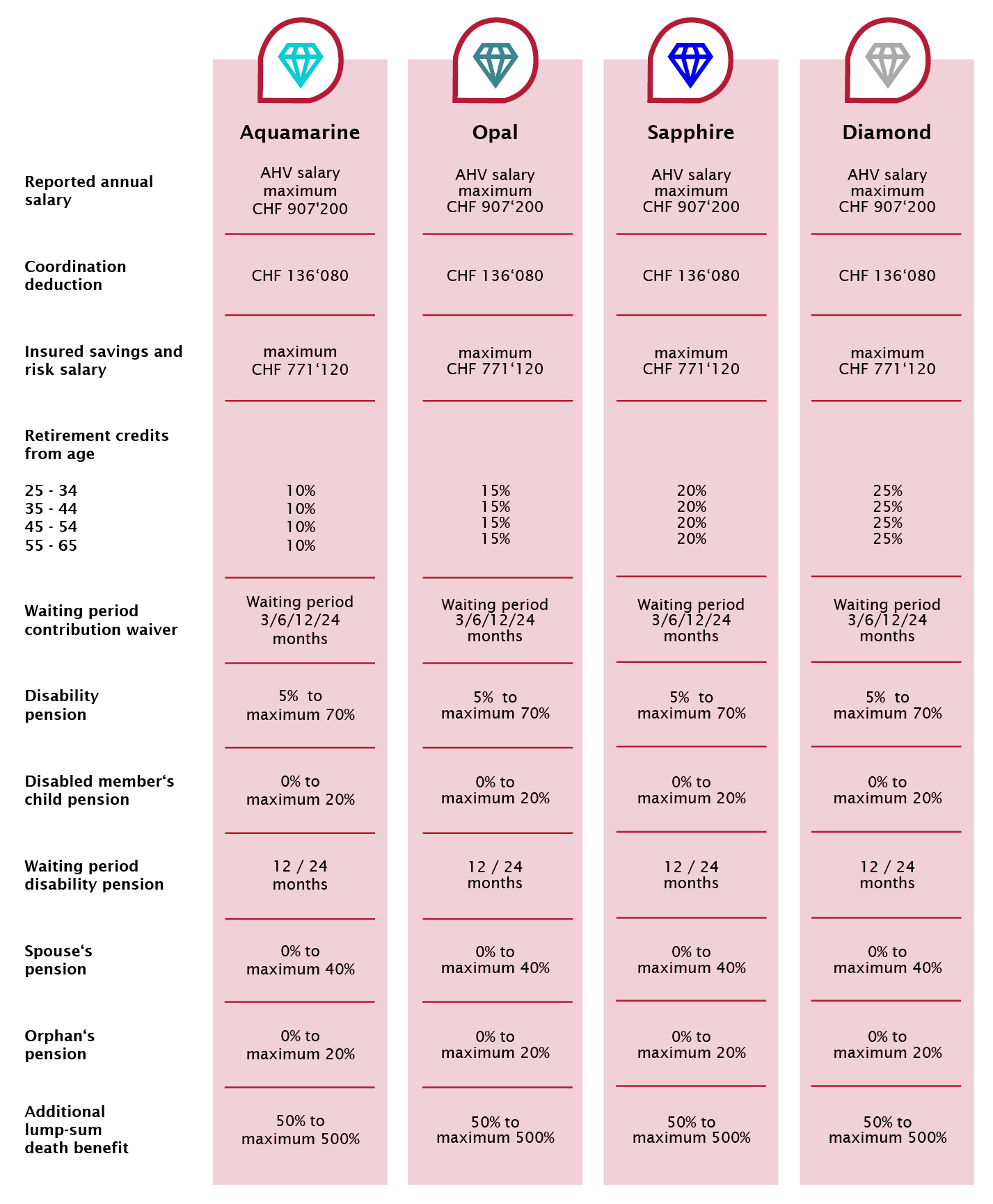

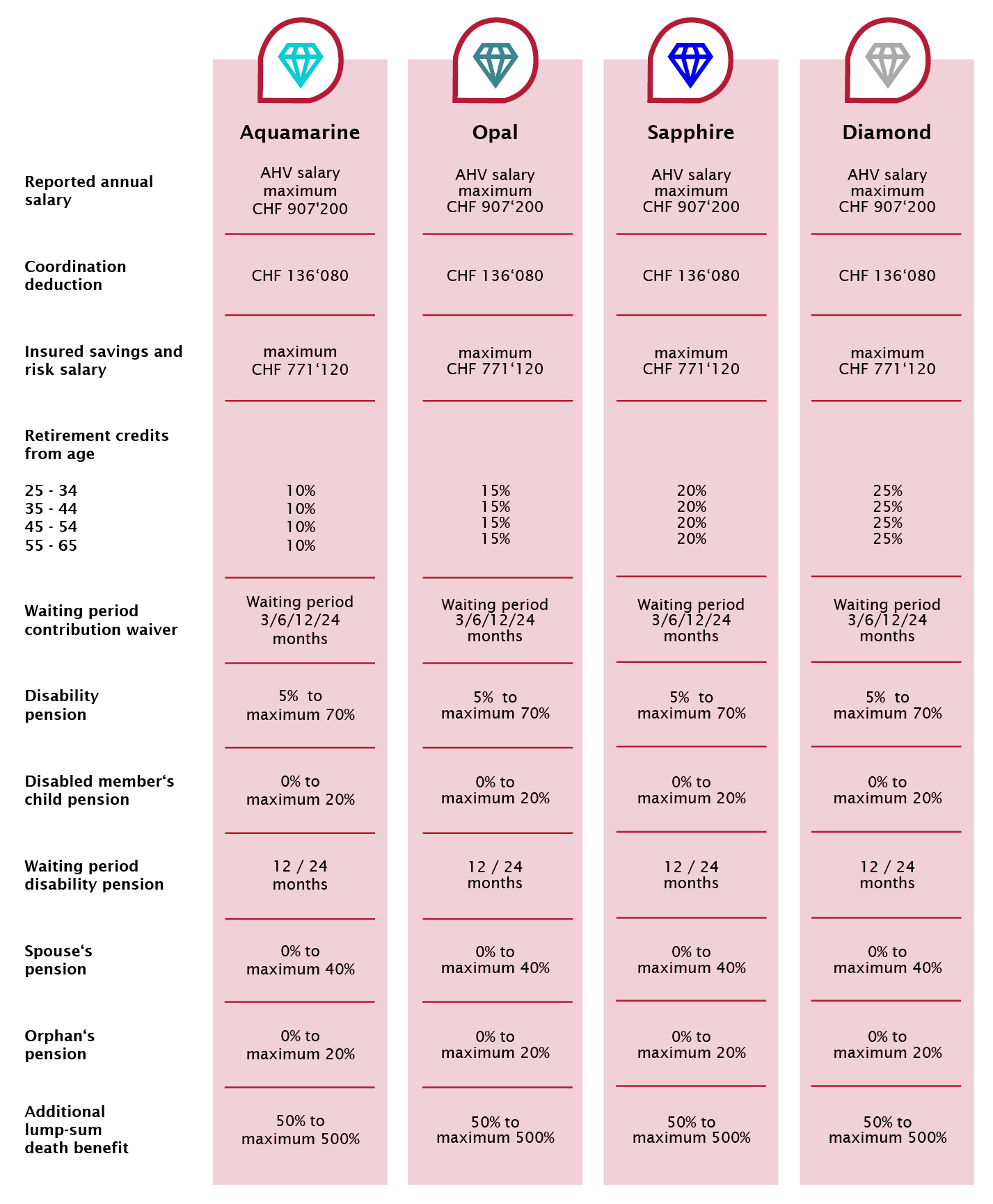

For their 1e pension solution, self-employed persons may choose from a selection of four pre-defined plans. As an independent pension platform, Liberty offers customised securities solutions from renowned banks and asset managers.

BVG pension solutions for self-employed in the sports industry

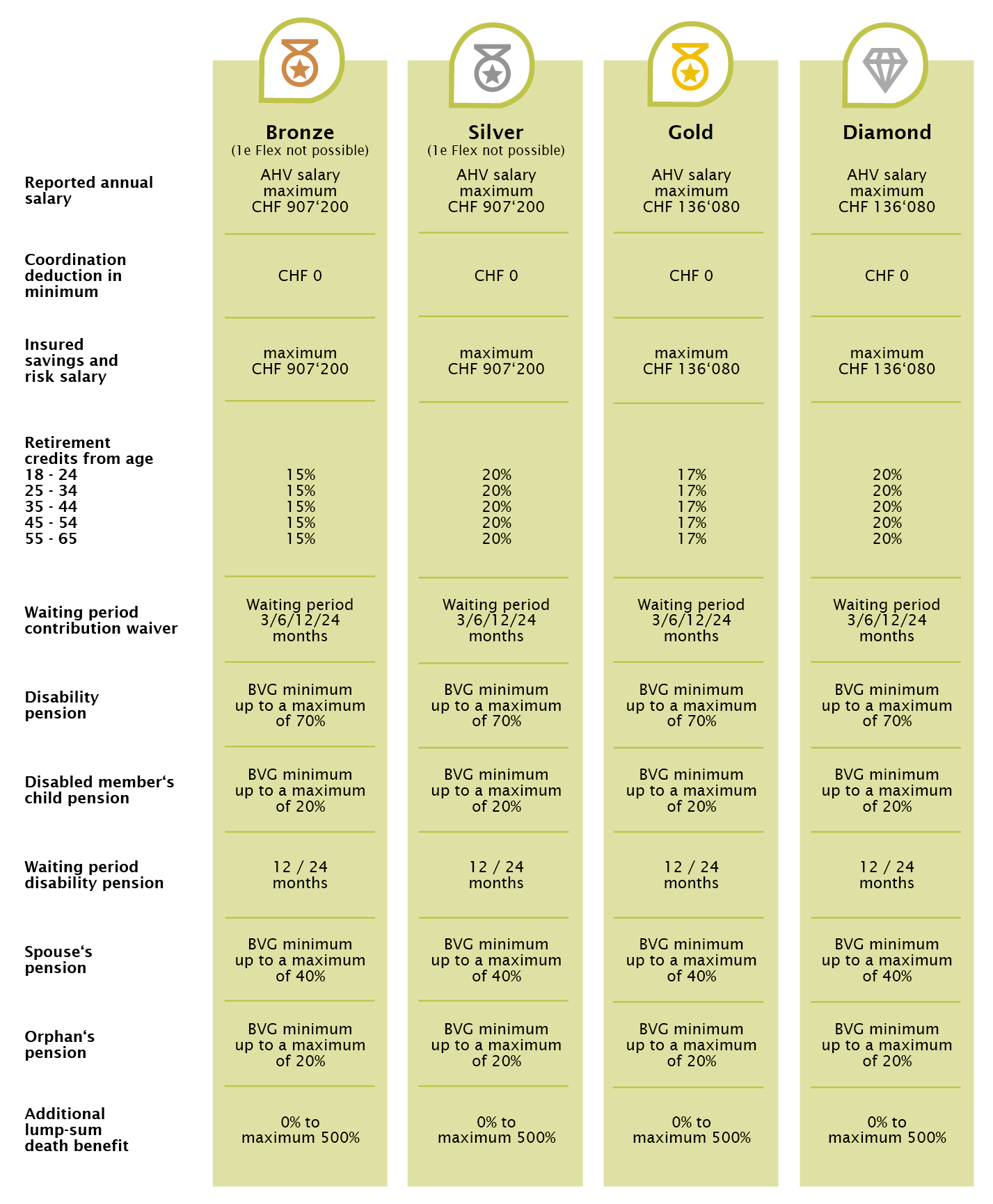

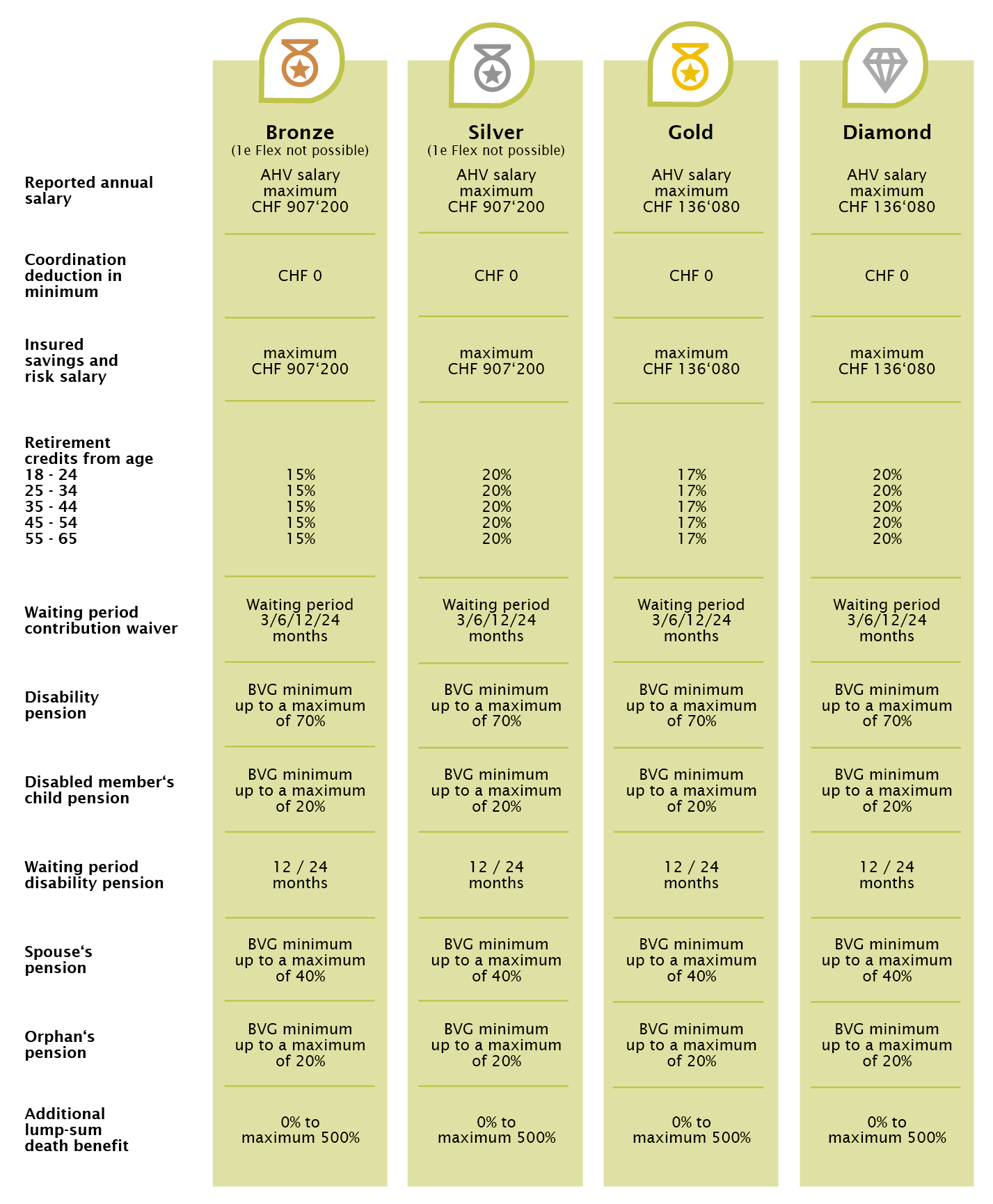

Self-employed athletes, sports consultants, sports planners, sports managers, sports coaches, physiotherapists and those in related professions in the sports industry can choose their BVG pension solution from one of four predefined plans.

1e pension solutions for self-employed in the sports industry

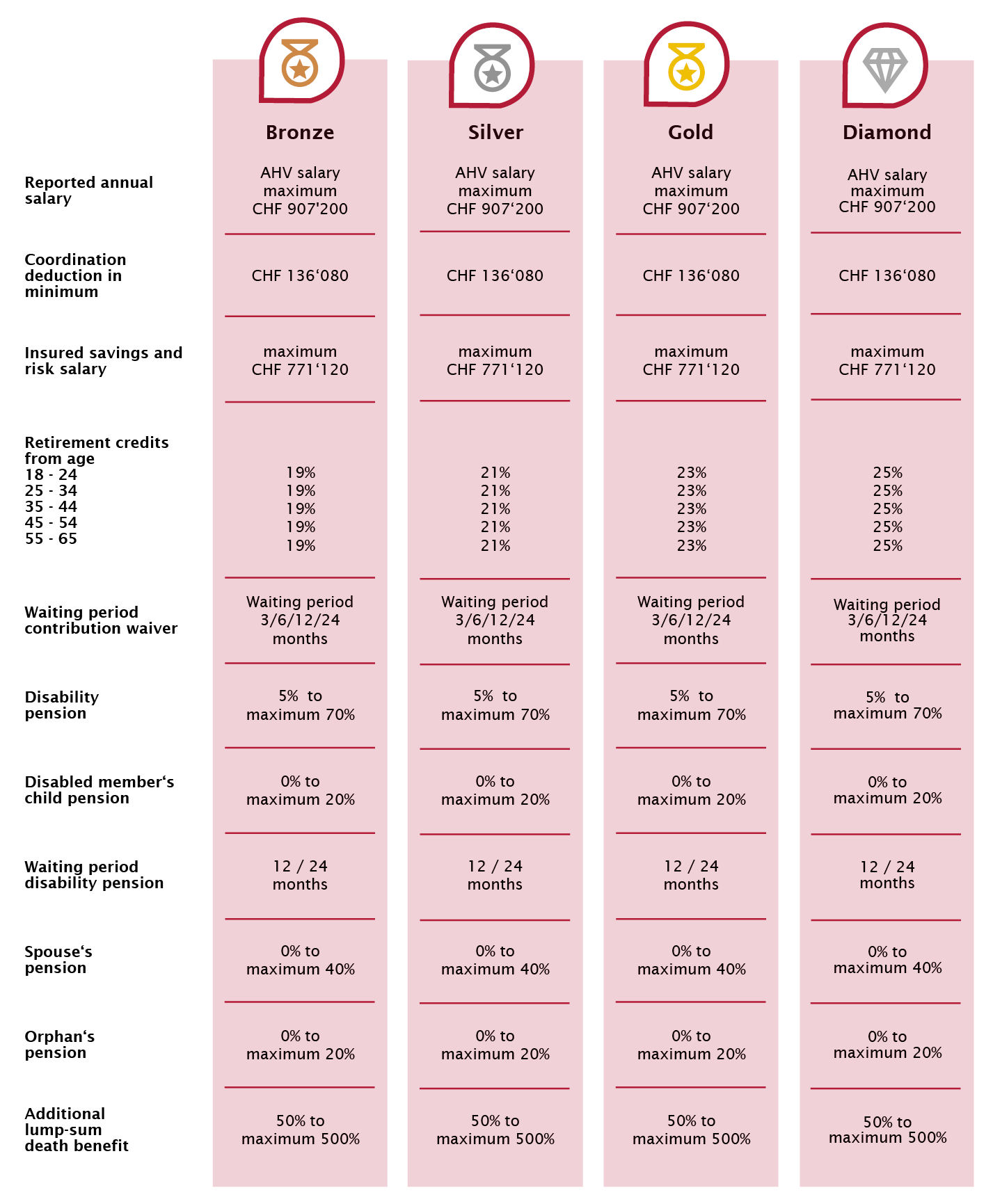

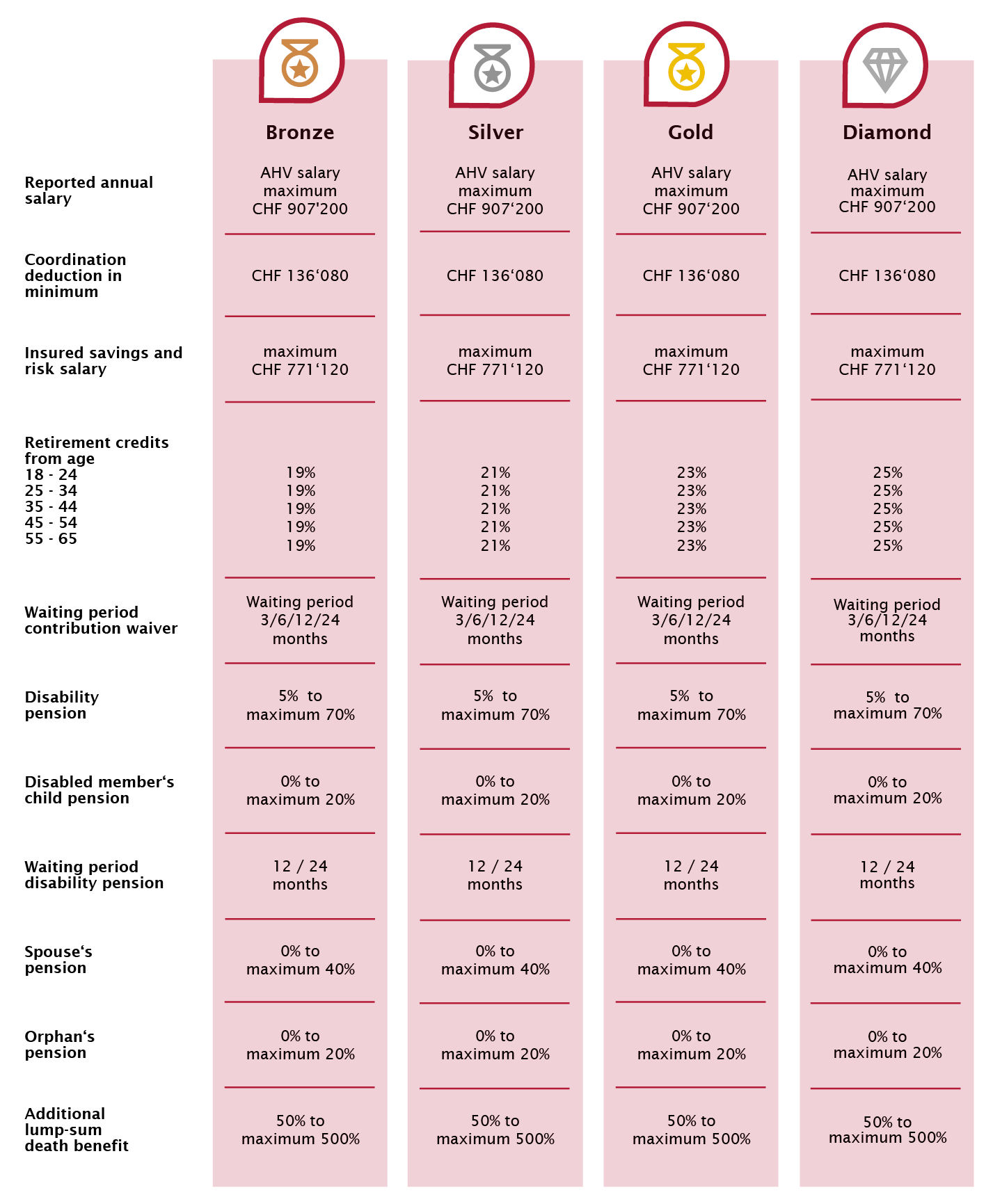

For the 1e pension solution, self-employed athletes, sports consultants, sports planners, sports managers, sports coaches, physiotherapists and those in related professions in the sports industry can choose their pension fund solution from one of four predefined plans. As an independent pension platform, Liberty offers tailor-made securities solutions from renowned banks and asset managers.

The Association also has a large network of partners renowned for their competence and quality of service.

Read more here